You may have seen Wood for Trees, part of Salocin Group, recently released its annual state of the charity sector report. We’ve had a good look through it, digested it and here are our thoughts…

Clare Arndell – Head of Media Planning & Operations

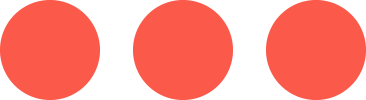

Reduction in DRTV recruitment

Source: InsightHub by Wood for Trees

The volume of donors recruited via direct response TV (DRTV) has dropped 48%, year-on-year. That’s a pretty big drop, especially when spend on TV actually increased 5% from 2022 to 2023 (source: Ad Intel 2022-2023) – so what could account for that?

The lifetime value (LTV) of donors recruited via DRTV can be high, so charities continue to use this medium despite the fact their cost per acquisitions (CPAs) are rising as media cost per thousands (CPTs) increase.

At the same time, we’ve seen that volume of donors directly attributed to DRTV is down, but campaign performance is on target, so a greater level of response is happening digitally, but likely to have been generated by DRTV.

We’ve also seen an increase in charities spending on legacy campaigns via DRTV. The attributed volume of responses from legacy campaigns is generally low and therefore not represented in these figures.

What does all this mean for charities considering DRTV for recruitment? TV continues to be one of the best all-rounders for charities as it drives both brand awareness – which is beneficial in the longer-term – and direct response. But clients and their agencies need to ensure campaign performance is viewed holistically, with more marketing mix analysis to truly identify the impact of DRTV spend.

Jodie Hanrahan – Media Account Director

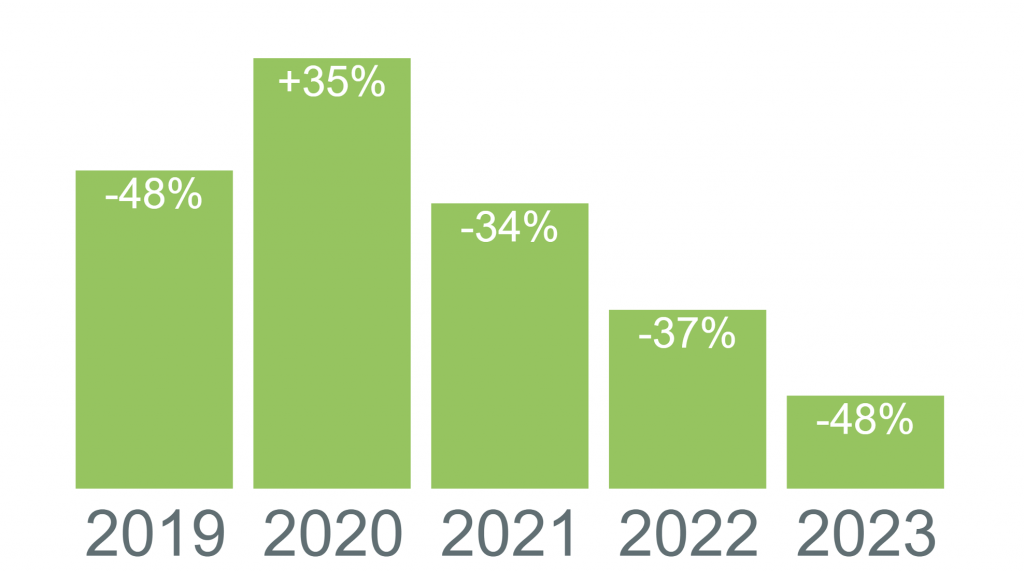

Cash vs. regular giving recruitment channels

Source: InsightHub by Wood for Trees

In 2023, we saw a bit of a shift in the digital recruitment of both cash and regular giving (RG); this recruitment channel seems to be more saturated with charities ramping up activity and targeting similar audiences, which in turn provides a lower percentage of recruits targeted this way.

Although we saw a dip with the introduction of GDPR followed by the pandemic in 2020, direct mail has always been a strong recruitment channel for charities. We can see recruitment is starting to build back up to previous high levels, with 43% of cash recruits being brought in via this channel. So, it’s worth considering bringing it back into the mix if you’re not doing so already.

Face-to-face hasn’t made much of a comeback for cash recruitment, though most charities choose to use this channel for RG due to the personable impact of an in-person conversation and strong conversion rate.

From 2023 performance, we can see face-to-face was by far the strongest recruitment channel for RG at 83%, this was supported mostly by digital, though the past three years has shown a decrease in digital recruits too.

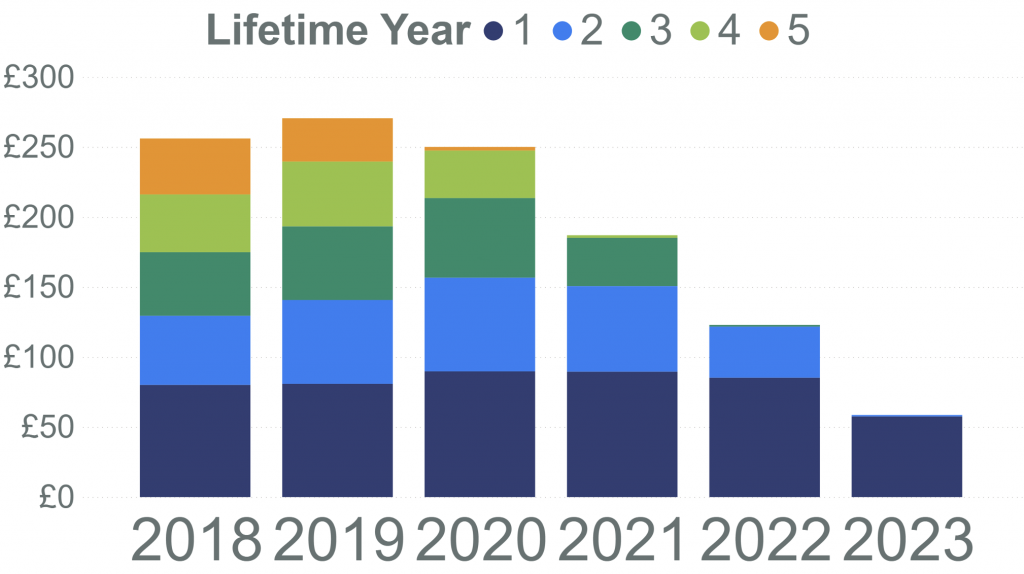

Luke Bamsey – Media Strategist

Due to remaining high levels of economic uncertainty for a lot of people, their ability to give higher amounts on a regular basis is constrained. The amount people are able to donate has declined, the volume of people wanting to donate regularly has seen an antithetical effect. This is evident in the latest state of the sector report.

Source: InsightHub by Wood for Trees

Recruitment levels of regular givers has increased. However, at an individual level, supporters are giving less than before, resulting in the LTV of RG supporters being down year-on-year.

Source: InsightHub by Wood for Trees

If charities haven’t already, the data suggests that offering a downgrade RG option to their current base may be a good way to keep supporters from cancelling completely. Having a strong CRM programme in place will help charities retain the higher levels of RG donors whilst the UK is still in this period of economic uncertainty.

However, looking further into 2024 and beyond, consumer confidence is on the increase, -19 April 2024 compared to -30 in October 2023, (Trading Economics, 2024). This is a vast improvement and one which is likely to carry on, resulting in an increase in peoples’ ability to give more on a regular basis. Therefore, charities should look to use upgrade comms in order to get donors to jump back to the higher individual RG donations, which would ultimately result in higher levels of LTV.

Overall, in the short term, charities should look to implement a downgrade option for their regular supporters, with the aim of retaining them. Later in the year/heading into 2025, if consumer confidence continues to see a positive trend, charities should go out with upgrade comms. Charities have recruited more RG over the past year, if retained through the next few months, we could see very positive levels of RG income in the future.

Lottie Heckman – Media Account Director

Regular giving retention

Source: InsightHub by Wood for Trees

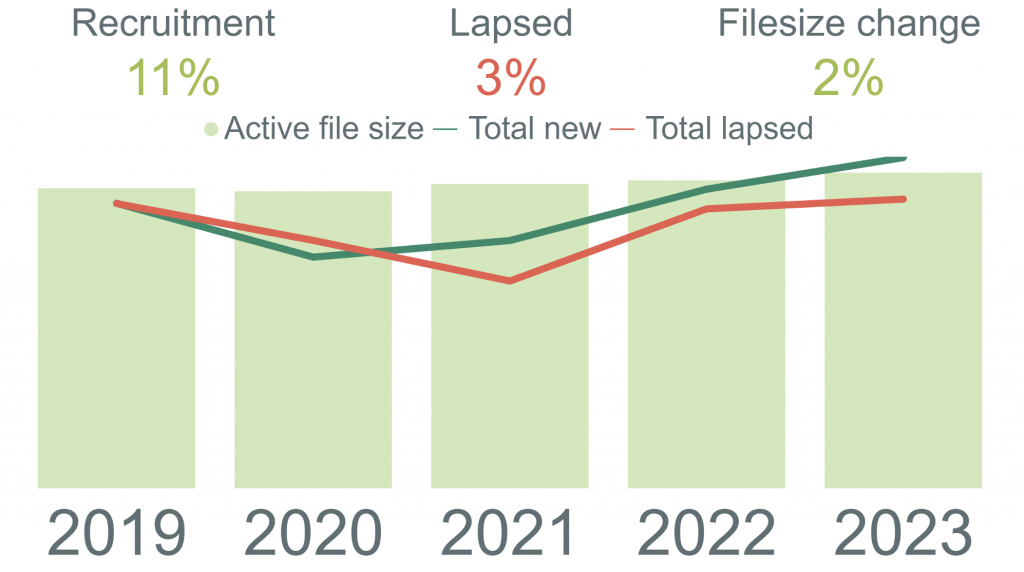

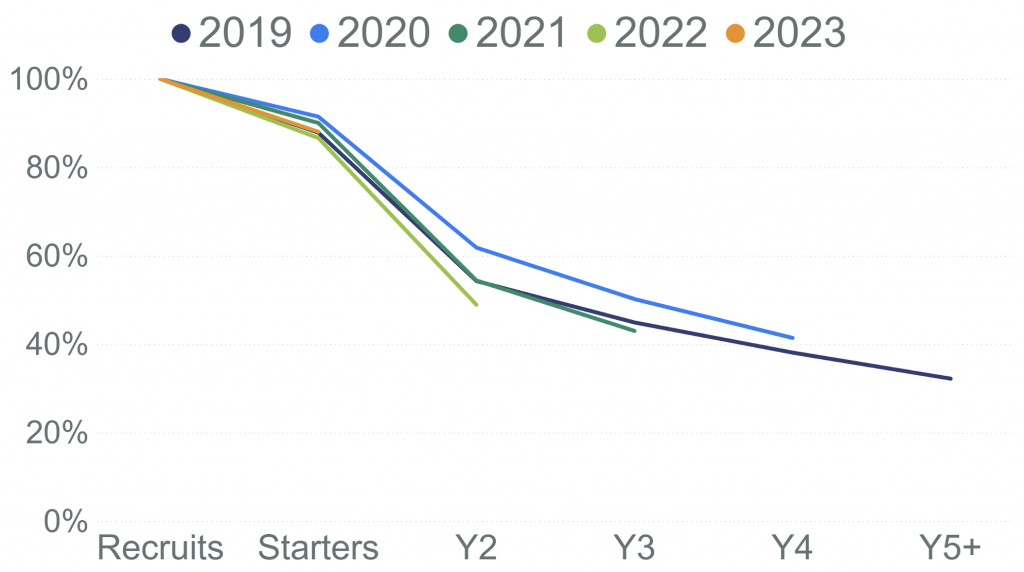

The latest state of the sector report shows a slight worsening in attrition rates over the past five years compared to the previous year’s figures, with 57% of regular donors lapsing within 12 months.

Notably, regular donors acquired through direct mail and face-to-face methods showed the highest attrition rates, while those acquired via digital and DRTV demonstrated higher retention rates. This aligns with our observation in client acquisition, where charities struggled to retain regular donors converted via face-to-face in 2023 due to constrained disposable income amid rising costs.

This analysis has led to strategic adjustments to enhance donor LTV. Some clients are improving internal communications by sending regular ‘thank you’ messages and updates on how their donation is making a difference. Additionally, charities are addressing the cost-of-living crisis in their messaging and offering existing donors the option to reduce their monthly contributions to prevent cancellations.

The 2023 CAF report emphasises the importance of building public trust for charities to secure donations. Donors want assurance that their contributions are used effectively and making a meaningful difference. I agree with this statement and it’s crucial for charities to remember this when communicating with their existing donor base. Providing regular updates on how donations are helping people in need is essential to maintain trust and engagement, particularly during a cost-of-living crisis.

Ben Briggs – Managing Partner

It’s been a rollercoaster ride for charities over the past five years. According to the state of the sector report, most channels, except for face-to-face, have seen a decline in income since 2022.

But it’s not all doom and gloom.

During the pandemic, donors gave generously to support various causes and income levels were unusually high. Now, they’re returning to similar or slightly higher levels than before 2020. As well as the natural return to pre-pandemic recruitment levels, there are a few reasons why donations have seen a slight year-on-year reduction:

- The Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 6.3% in the 12 months to September 2023, the same rate as in August

- The Consumer Prices Index (CPI) rose by 6.7% in the 12 months to September 2023, the same rate as in August

- The war in Gaza will have undoubtably had an impact on donor attention and spend – the war started on 7th October

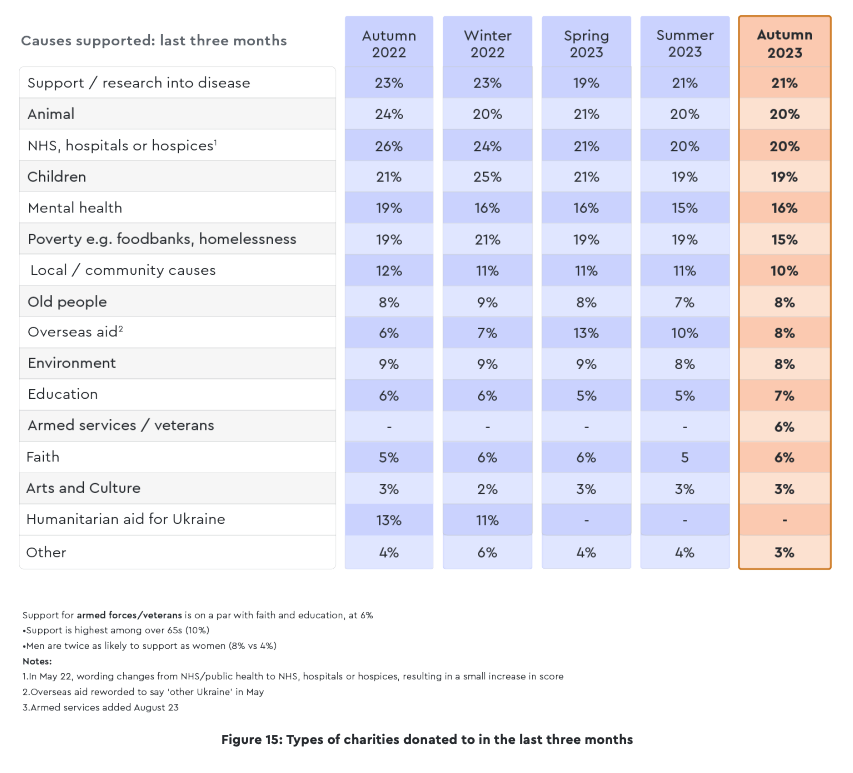

- The Donor Pulse Report: Autumn 2023, which reports the percentage of people donating to charities, with the exception of a couple of sub-verticals, has either decreased or stayed the same quarter-on-quarter

Source: Donor Pulse Report: Autumn 2023

Digital income was the star performer in 2021 and 2022, thanks to high-profile appeals and increased use of online platforms. It dropped again in 2023, but it’s still higher than 2020 levels and has potential for growth as more charities invest in digital innovation and engagement.

Direct dialogue and direct mail income, which rely on face-to-face interactions, also fell after peaking in 2021.

This suggests charities may be exploring other channels or facing challenges in engaging donors, and direct dialogue is likely to continue to suffer with a reduction in footfall, with a 7.4% drop in shopping centres and 4.2% less in the high street in December 2023, especially with an aging demographic who are not having their simple health needs met supporting the drop in presence on the high street.

DRTV income also took a hit, which could be due to high costs and low returns, competition from other media outlets, and changing donor preferences.

Digital and direct mail channels are becoming increasingly important, accounting for more than half the total income in 2023. Meanwhile, face-to-face income is dropping year-on-year and is now the least profitable channel. This raises questions about its sustainability and effectiveness in the long term, especially with fewer people on the high street.

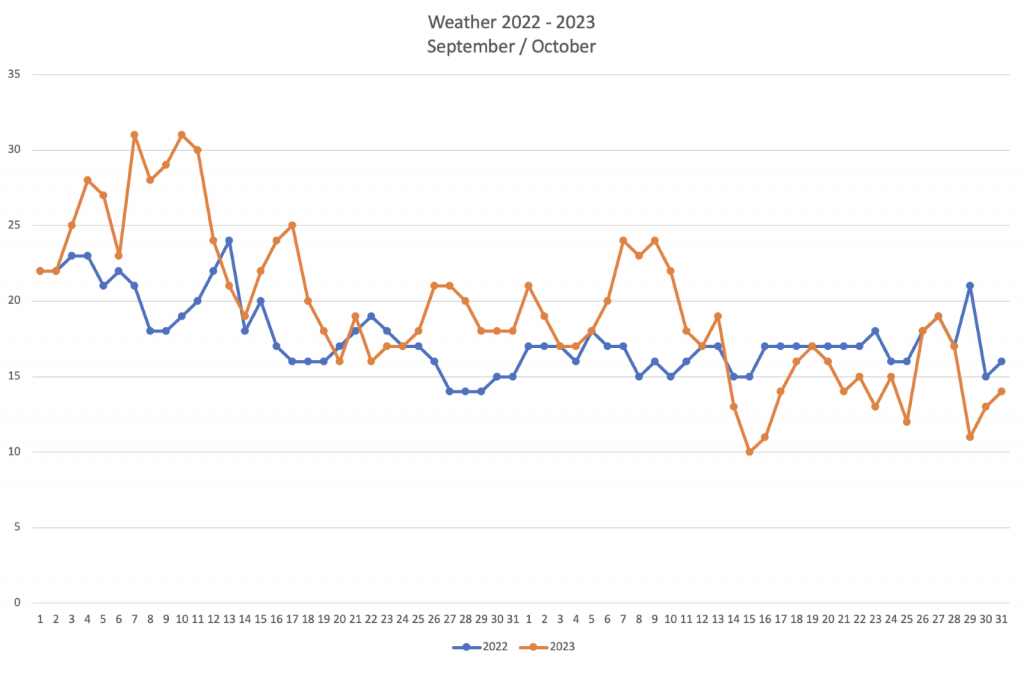

Evident in late 2023, as cash giving increases, direct mail plays a significant role. Face-to-face is most successful in the summer months when the weather is good, but it recedes as winter draws in, this is obviously unsurprising but it’s a trend we may see shift as the climate changes due to global warming.

The graph above shows the year-on-year weather trends for September and October, with the UK experiencing a sustained period of temperatures in the 20’s and 30’s, which is a factor we know had an impact on income for homeless charities.

To find out more, download the state of the sector 2024 report and watch the corresponding webinar replay from our friends at Wood for Trees.