You may have seen Wood for Trees, part of Salocin Group, recently released its six-monthly update on the state of the charity sector report (January-June 2024). We’ve had a good look through it, digested it and here are our thoughts…

Lori Cridland – Media Account Director

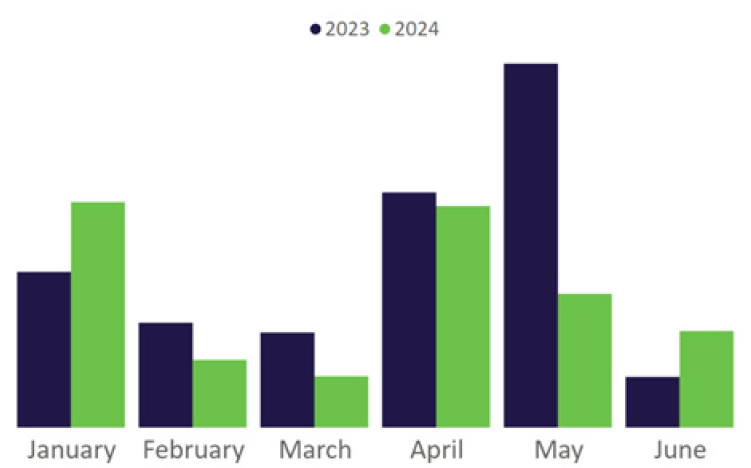

First half of the year (H1) monthly year-on-year (YoY) income is up on last year

Income – H1 monthly YoY, including legacy giving

Considering the majority of households are implementing cost-cutting measures, due to the cost-of-living crisis, and there was a 1.7% rise in inflation (Sep 24 vs 23), it’s promising to see overall charitable income has already surpassed 2023 levels for H1 this year. An element of this could be down to increasing public trust in charities, which is now at a 10-year high (Gov.uk). Ahead of the traditional Christmas giving season, where charitable giving hits its peak, I think we can safely assume an overall increase in income YoY, particularly with a wide range of ways to donate now readily available across the UK.

Clare Arndell – Media Planning Director

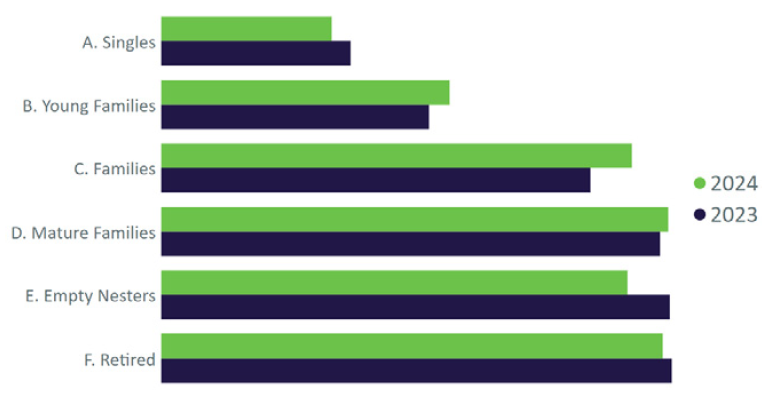

Why might the demographic profile of donors have changed?

Life stage by recruitment year: January to June

Affluence by recruitment year

There could be several reasons for the trend we started to see last year; more donations from people who are less affluent and younger.

The first possibility is the increased sense of community post-pandemic, with people feeling great compassion for those who are struggling. Even if they can only give a small amount, there’s a shared sense of hope that many small amounts given together can affect real change.

The second possibility is that there’s a proliferation of content on social media that calls for people to act and/or give, to support causes they feel a strong connection with. You only have to see how much content there is on TikTok concerning the middle east conflict to realise what an impact this issue is having on younger generations.

Lottie Heckman – Media Account Director

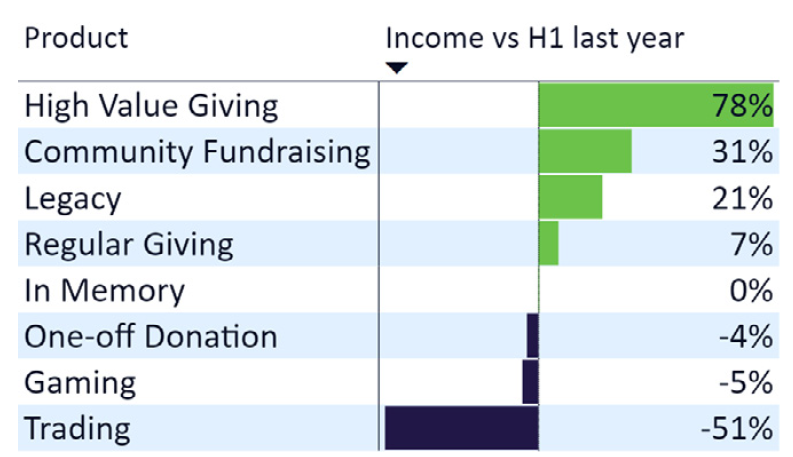

Why has there been such a big increase in high value donations?

Income trend matrix

There’s been a significant increase in high-value donations over the past six months, compared to the first half of 2023. This growth is largely driven by the success of a specific charity’s campaign, so it’s important to acknowledge this may have slightly skewed the overall results.

The report also highlights the positive impact of recent economic improvements. With GDP rising by 0.7% in the first quarter (Q1) and 0.6% in the second quarter (Q2), people appear to have more disposable income, allowing for more generous donations. Additionally, donor behaviours have shifted; while the number of donations YoY has decreased, the average gift size has increased. This pattern indicates donors are becoming more selective, choosing to give larger amounts to fewer charities.

In light of these trends, charities are encouraged to refine their strategies to stay front of mind for potential donors. A strong marketing approach, combined with targeted messaging, is key to securing these larger donations and maximising fundraising efforts in an increasingly competitive environment.

Jodie Hanrahan – Senior Media Account Director

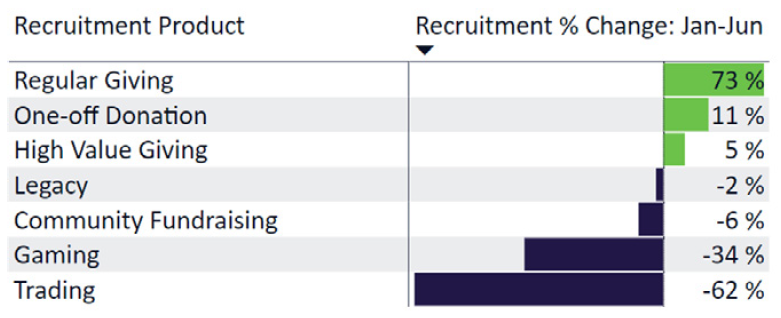

Recruitment volumes up YoY

Recruitment – H1 2024 vs H1 2023

Across H1, driven by Q2, the number of new donors being recruited is up YoY. This has been impacted mostly by regular giving showing a shift in recruitment strategy more towards longer-term value from repeat donors. This activity is prominent in January, showing those post-Christmas regular giving campaigns are paying off and it could be a good time to test this further.

Recruitment matric per product

One-off donations and high-value giving are also up YoY, with spikes in April and May, as charities begin to test outside of noisy periods to gain better cut-through. We see recruitment in gaming down YoY, particularly in the spring months, which seems to have been replaced with a one-off donation donor recruitment focus, suggesting stronger lifetime value from this donor type.

The majority of income has been generated from face-to-face giving, which is having a comeback since the pandemic. Other channel activity income is the same or lower YoY, with a shift in channel mix, with cold direct mail 21% down as the focus for this channel switches to warm direct mail and recruitment budgets sit elsewhere.

Rachel Prior – Media Strategist

A decrease in direct mail

Direct mail

Direct mail recruitment is more than 20% down on H1 2023 due to volumes being much lower in May compared with the same month last year. If we look at the data, we can see, via our own Adalyser report, that spend for charities on direct mail in H1 was down 67% YoY , which may account for the decrease. This could be due to the increase in print and postage costs, leading to print channels becoming less cost-efficient. However, this isn’t something we’ve seen across our clients at Join the Dots.

It’s possible we’re merely becoming smarter, utilising data tools that can find and reach communities of key audiences to enable more efficient targeting. Meaning we can use significantly less volume to achieve the same, if not better, results.

If you’d like to find out more about the current state of the UK charity sector, you can download the full report here.